'£54k to rent five phones is killing my business'

BBC/Caroline Bilton

BBC/Caroline BiltonThousands of small businesses across the UK are being charged "grossly inflated" prices to rent phone equipment on lengthy finance deals because of "unethical" sales practices used by various companies, experts have told a BBC investigation. Some business owners say the costly contracts are leaving them on the brink of collapse.

Gary Pride's business has survived a recession, a fire and the uncertainty of the Covid pandemic. But what is leaving his business on the verge of closure is the £54,432, excluding VAT, that he is paying over 10 years to rent just five phones and related software.

He says signing his phone contract has "ruined his life", adding: "I've not been paying myself so I could pay that bill, every month."

Mr Pride, who has run his graphic design business for 19 years, says the financial stress has affected his mental health.

Breaking down in tears as he speaks from his workshop in Bradford, Mr Pride says his sleep has been affected and he has been taking antidepressants.

"I feel I've let myself down and I've let all my staff down," he says.

Mr Pride first signed with the telecoms company 4Com in 2017.

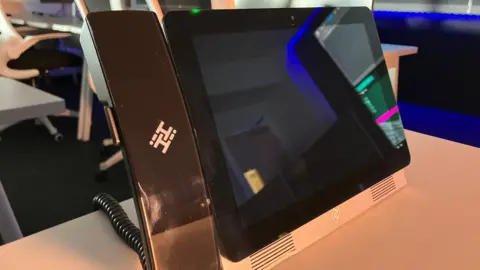

The contract he signed was a seven-year finance deal with a separate company to rent 4Com's HiHi phones and software.

He says the true cost of his contract was only revealed after a two-year "introductory offer" from 4Com ended and his monthly bills soared from just over £200 per month to more than £550 per month.

'No choice but to stay with them'

The contracts, seen by the BBC, do state they are a "universal rental agreement" and that the customer would be "billed separately for the system rental by a third-party funder". However, Mr Pride claims he was not made verbally and fully aware of the finance deal at the time of signing, and the total cost to his business.

"I just feel like I've been conned," he says, adding "no-one on this planet would have signed" had they known the true extent of the contract.

He complained to 4Com and was offered a chance to upgrade his phones and receive a "loyalty rebate" if he signed a new contract.

He says he had "no choice but to stay with them" in order to keep his monthly payments down.

His new seven-year contract included another finance deal for the upgraded phones but he still had to pay for the initial agreement - bringing his total amount of finance to more than £54,000 to be paid over 10 years.

This money, owed to the finance company, is on top of additional fees he has to pay 4Com for services such as maintenance and broadband.

It is a sum of money Mr Pride is finding difficult to accept.

"I could get a top-of-the-range Range Rover for what I've paid for them," he says, adding: "I just feel stupid."

Mr Pride says he cannot afford the £24,584 he has been quoted by the finance company to exit the agreement early.

He is one of several cases seen by the BBC who have signed a second lease agreement just two years into their long-term contracts.

BBC/Caroline Bilton

BBC/Caroline BiltonA former 4Com senior manager, who asked to remain anonymous, told the BBC it was not uncommon for the company to tie customers into multi-year leases which 4Com appeared to frame as "upgrades".

"They're not only getting ripped off once, they're getting ripped off again two or three years later and 4Com are repeatedly receiving money from the same deal," they said.

They said the Bournemouth-based company, which says it has around 17,000 customers nationwide, was making "hundreds of thousands a month" out of the "grossly inflated" deals.

Mr Pride is one of more than 160 small business owners who contacted the BBC after an undercover investigation last year.

They claim to have been mis-sold phone contracts and leasing agreements by 20 different telecoms companies using the same finance firms.

They all claim the sales pitch differed from what was in the written contract and the sales representatives had not drawn their attention to the fact they would be renting equipment on finance and would face extra charges. They say they were not given time to read the contracts and were strongly encouraged to sign on the spot.

Once they had signed, all were tied in for five or seven years. Unlike consumer contracts, there is no cooling-off period for business-to-business contracts in the UK.

More than half of those who contacted the BBC were 4Com customers running small family businesses, with fewer than 10 employees, and spoke of the toll it was taking on them:

- One woman called the BBC in tears claiming she was on the brink of losing her business

- Another said the confusing contracts had left them "unsure exactly what we are paying"

- In one case, a company was offered a discount on its termination contract if it agreed to sign a non-disclosure agreement

4Com says it is transparent with customers about its prices and services, and strongly denies the claims that it has inflated prices and customers have been mis-sold contracts.

It says upgrades are not compulsory and that all sums and upgrade details had been transparently presented to Mr Pride.

A spokesperson says the "historic examples" the BBC shared with the company relate to less than 1% of its customers.

The BBC secretly filmed a 4Com sales pitch last year in which a salesman verbally told the customer things that did not match the written contract:

- The salesman said the price per month would be fixed, and only admitted it was not when he was questioned about it after prompting us to sign. The contract showed that after the first year the customer could potentially be paying thousands of pounds more over the remainder of their contract

- He said any upgrade would mean the customer's initial contract would be "wiped" - but customers like Mr Pride, who agreed to upgrades, were still paying for their old equipment even after they had upgraded

- The salesman did tell the customer he was signing a "lease purchase" but said after five years, the customer would own the equipment - but the contract said it was rented

4Com says its checks and balances on the sales process, and extensive staff training, go beyond common industry practice. The salesperson we filmed no longer works for 4Com.

The BBC showed several 4Com contracts to four independent telecoms experts with extensive industry experience.

Although the cost of a HiHi phone is not made publicly available, the experts believed customers had been charged inflated prices - in some cases many times more than "the industry standard".

They told us some of the additional services mentioned by 4Com came as standard with other suppliers and other services were not necessary for small businesses.

They also alleged that leasing companies were "enabling" and "approving exploitative agreements" at the expense of small businesses.

One expert, who wanted to remain anonymous, said the seven-year contracts appeared designed "solely to maximise finance revenue rather than meet a legitimate business need".

Another expert, Jonny Rae, a telecoms consultant who has worked in the industry for 15 years, described the prices as "outrageous" but said he was "not surprised" as the "unethical" practices had been going on "for over a decade".

BBC/Caroline Bilton

BBC/Caroline Bilton4Com told the BBC it offers small businesses "superior telephony solutions" giving a "competitive edge for a fair price", and has the loyalty of thousands of customers.

It says most have "no complaints" about its sales process but that where necessary, it has a "strong track record" of fixing issues quickly.

4Com says the price comparison to cheaper products is unfair because the HiHi phone is high quality, and its prices include additional services.

But Mr Rae said customers were being charged for basic services such as call logs, which "come with any telephone system for free".

He said it was "almost laughable" that they were being "bundled" into a finance agreement and approved by a finance company.

"It's the opposite of transparent," he said.

"It's confusing enough to me - let alone the customer."

Richard Jackson runs a small letting agency in Sheffield.

He signed a finance agreement through 4Com in 2021 which charged him more than £20,000 for three phones and software.

Although he felt "angry", "ripped off" and "trapped", Mr Jackson needed a fourth phone.

When he asked for a price, 4Com offered to provide four Yealink handsets on a new £40,391 seven-year finance deal, excluding VAT.

Experts told the BBC all four phones could easily be bought outright for less than £2,000. They said even when software had been taken into account, the figure quoted to Mr Jackson had been "grossly inflated".

BBC/Richard Jackson

BBC/Richard JacksonMr Jackson turned down the offer and is continuing to pay off his £20,000 debt - which he says he wishes he was spending on his "dream bike", or an extra full-time member of staff.

In response, 4Com said it had not found any evidence that Mr Jackson was mis-sold or that his prices had been inflated.

Many of the companies who the BBC spoke to had raised their complaints with the Communications Ombudsman but they were not upheld.

While the Communications Ombudsman can look at service-related complaints like mis-selling of phone systems, the finance agreements are typically structured as "unregulated" business leases.

These fall outside the direct supervision of the Financial Conduct Authority, especially when signed by limited companies.

A spokesperson for the government regulator Ofcom said: "If we see evidence of widespread issues, we've shown we can and will consider taking action."

The industry body representing the asset finance sector, the Finance and Leasing Association, said its members "seek to put the customer first" and they "recognise that SME owners face a raft of daily pressures".

They said: "It is important that clients also recognise their responsibility to scrutinise the terms of contracts with suppliers to ensure that the agreements will meet their needs."