Nuclear deal: Is Iran's economy better off now?

AFP

AFPThe 2015 nuclear deal between Iran and six world powers - the US, Russia, China, the UK, France and Germany - lifted international sanctions on Iran's economy, including those on oil, trade and banking sectors.

In exchange, Iran agreed to limit its nuclear activities.

US President Donald Trump has repeatedly threatened to abandon the agreement and will make a decision on 12 May about whether to reintroduce sanctions from his country.

So, as that deadline draws nearer, Reality Check examines how Iran's economy has fared since the nuclear accord came into effect.

AFP

AFPHow much have oil exports boosted Iran's economy?

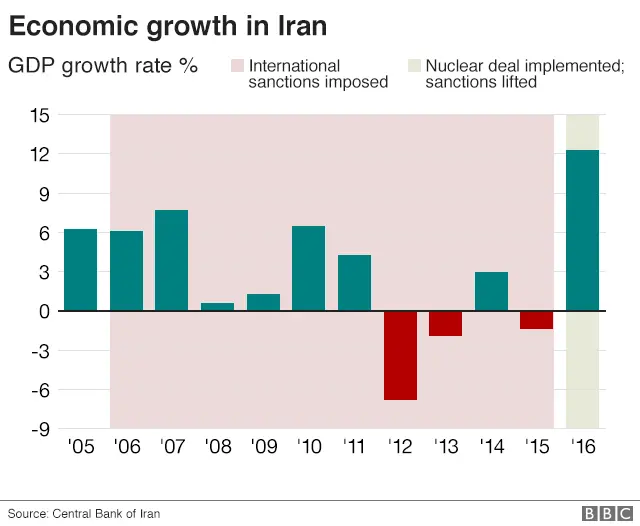

Iran's economy was in a deep recession in the years before the nuclear agreement. But the International Monetary Fund reported that the real GDP of Iran grew 12.5% in the first year following the implementation of the deal.

Growth has fallen since then, and the IMF estimates the economy will grow at 4% this year, which is healthy but below the 8% target Iran had for the five years following the deal.

That initial boost was almost all thanks to the hike in oil exports.

Sanctions on Iran's energy sector halved the country's oil exports, to around 1.1 million barrels per day in 2013. Now Iran exports almost 2.5 million barrels daily.

AFP

AFPWhat about other famous Iranian exports, like pistachio nuts?

Iran's non-oil exports in the year to March 2018 reached $47bn (£34.5bn) which is almost $5bn more than the year before the nuclear agreement.

According to Iran's ministry of agriculture, the export of "signature items" such as pistachio nuts stood at $1.1bn in the same period, slightly lower than the previous year.

But Iran's agricultural exports, including pistachios and saffron, are more affected by the country's drought, rather than sanctions or trade relations.

Following the nuclear agreement, the US lifted a ban on Iranian luxury items such as carpets and caviar. Sanctions cut exports of Iranian carpets to the US - its biggest market - by 30% .

Iran's trade with the European Union has increased significantly thanks to the lifting of sanctions but China, South Korea and Turkey remain Iran's top three trading partners.

AFP

AFPDid the nuclear deal stabilise Iran's falling currency?

In 2012, the rial lost almost two-thirds of its value against the dollar because of sanctions and domestic mismanagement of the currency market. The sanctions limited Iran's oil revenues and its access to the global banking system.

Iranian President Hassan Rouhani promised the nation that following the nuclear deal "you will not see the exchange rate go up every hour".

Mr Rouhani managed to deliver on that promise by keeping the Iranian currency stable for almost four years. But in late 2017, when President Trump refused to certify the nuclear deal to Congress, the rial started to fall again.

The rial has lost almost half of its value against the dollar since last September. Many Iranians have been buying hard foreign currency to hedge against the possible future collapse of the nuclear deal, the return of sanctions and a fresh currency crash.

It was reported that some $30bn of capital left Iran in the first quarter of 2018, mostly to neighbouring countries and the Caucasus.

The Iranian government has since launched a crackdown on the foreign exchange market, banning exchange offices from selling hard currency and introducing limits (at $12,000) on cash possession - all in a bid to rescue the rial.

Are ordinary Iranians richer because of the nuclear deal?

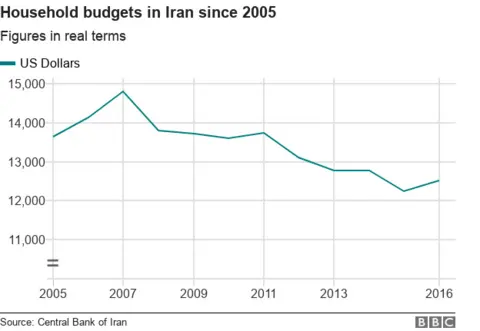

Analysis by BBC Persian of figures from the Central Bank of Iran shows that household budgets (the value of all the goods and services used by a household) have fallen in real terms from $14,800 in 2007-08 to $12,515 in 2016-17.

Household budgets declined steadily for seven years until 2014-15 when the nuclear deal was struck and increased slightly the following year.

The analysis also shows that Iran's middle class has been hit the hardest in the past decade. While the average household budget has fallen 15%, the figure is 20% for middle-class families.

Experts blame a combination of domestic mismanagement of the economy and international sanctions for the fall in household budgets.

Most of the post-nuclear deal boom came from increased oil revenues that go directly into the government coffers and that takes time to trickle down into people's pockets.