Ukraine war: G7 and allies approve cap on price of Russian oil

Getty Images

Getty ImagesThe G7 group and its allies have officially approved a cap on the price of Russian oil.

In a joint statement, the G7 and Australia said the price cap would come into force on 5 December or "very soon thereafter".

It comes after the European Union agreed on the price cap after persuading Poland to back it.

The plan, which stops countries paying more than $60 (€57; £48) a barrel, needed the agreement of all EU states.

Poland announced its support on Friday after being reassured the cap would be kept at 5% lower than the market rate.

A price cap was put forward by the G7 group of nations in September and aims to stop Moscow profiting from oil exports while avoiding a price spike.

It had been reported that the EU wanted to set the cap at $65-70 but this was rejected by Poland, Lithuania and Estonia as too high.

Warsaw had wanted the value to be as low as possible and had held out while it examined an adjustment mechanism which would keep the cap below the market rate as the price of oil changed.

On Friday, Russian Urals crude was trading at $64 a barrel.

The decision to impose a price cap was taken to "prevent Russia from profiting from its war of aggression against Ukraine," the joint statement read.

It said the move aims to "support stability in global energy markets and to minimise negative economic spillovers of Russia's war of aggression, especially on low-and middle-income countries, who have felt the impacts of Putin's war disproportionately".

The agreement of a price cap comes just days before an EU-wide ban on Russian crude oil imported by sea comes into force, also on 5 December.

The price cap - which is meant to affect oil exports worldwide - is meant to complement that.

Countries that sign up to the G7-led policy will only be permitted to purchase oil and petroleum products transported via sea that are sold at or below the price cap.

Ukraine's western allies plan to deny insurance to tankers delivering Russian oil to countries that do not stick to the price cap. This will make it hard for Russia to sell oil above that price.

G7 finance ministers said in September that their plan to limit the price of Russian crude would reduce Moscow's oil revenues and its ability to "fund its war of aggression".

White House National Security Council spokesman John Kirby welcomed the agreement of an EU price cap on Friday, saying it would slow Russian President Vladimir Putin's "war machine".

Russia denounced the scheme, saying it would not supply those countries which enforced a price cap.

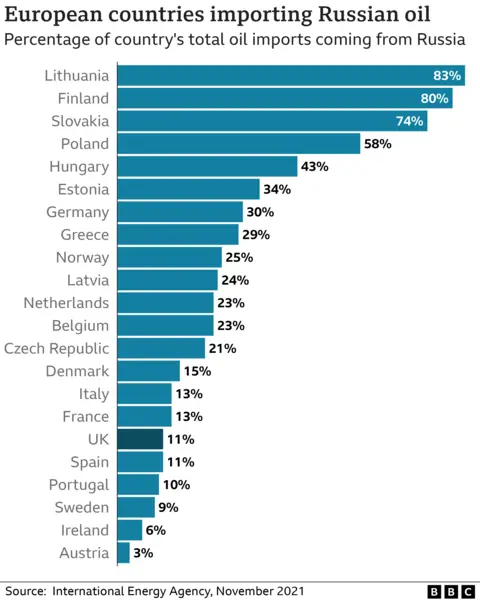

Before the war, in 2021, more than half of Russia's oil exports went to Europe, according to the International Energy Association. Germany was the largest importer, followed by the Netherlands and Poland.

But since the war, EU countries have been desperately trying to decrease their dependency. The US has already banned Russian crude oil, while the UK plans to phase it out by the end of the year.

Though the measures will most certainly be felt by Russia, the blow will be partially softened by its move to sell its oil to other markets such as India and China - who are currently the largest single buyers of Russian crude oil.