The shifting sands of shopping

Getty Images

Getty Images- Shop sales in Scotland have returned to pre-pandemic levels, according to Scottish Retail Consortium (SRC) figures.

- The SRC says part of the upturn is due to rising prices rather than sales volumes.

- Inflation and long term changes to the retail environment continue to present huge challenges

The return to pre-pandemic level of sales isn't much of an achievement if it is caused by price inflation. And after a severe battering in recent years, the cost-of-living crisis confronts retailers with new challenges.

This was the sector that wasn't just hit hard by Covid, but was already struggling due to structural change. So it was never likely to be a full recovery, but an acceleration of existing trends and new business shapes emerging.

The growth in grocery home delivery was slowing up until pandemic hit. Lockdown then forced a rapid shift to consumer habits that have continued to be dynamic between shop visits, use of convenience stores and big weekly shops.

The decline in conventional shopping, particularly on high streets, raises questions much bigger than sales figures, prompting retailers to set out how they can make shopping a more appealing prospect.

As we heard earlier this month in a refresh of their approach to town centres by the Scottish government and Cosla local council body, recovery for shopping brings many more factors into play than consumer choice and spending levels.

Getty Images

Getty ImagesTheir response stated that town centres are "the beating heart of our communities and country. Towns are full of emotional and personal connections that go way beyond the physical environment. They form part of our personal, community and national identity and deliver outcomes at the social, environmental as well as the economic level".

Even as retail recovers, the move to online sales continues. It, too, can be a dynamic and challenging environment to do business.

Those who do well in it require to invest and keep ahead in software and security, in customer experience online, in deploying data to understand customers better, and in fulfilment, meaning ever-rising expectations of how fast goods can be delivered.

That's delivering tens of thousands of new jobs - not in conventional shop sales but in new roles, of software design and engineering, of online entrepreneurs and of lower-wage warehouse and delivery roles.

Shopify, a Canadian-based software platform on which many of the smaller retailers sit, claims to be behind the creation of nearly as many jobs in 2020 as were lost that year.

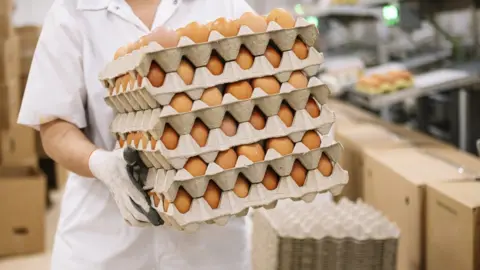

A third factor to this dynamic, price-inflating business environment is the pressure that retailers are putting on their suppliers, and nowhere more than in food supplies to the big supermarket chains.

Getty Images

Getty ImagesEgg producers are one example, warning that current prices being paid will render them non-viable. A large share have told their trade body they will give up if they can't cover the 50% recent growth in hen food costs, 40% rise in energy bills, 30% more for fuel, while labour and packaging costs have also been on the rise.

How those supplier relationships play out through the current cost-of-living crisis will contribute to the shape of the retail sector that emerges from it.