House prices in first annual fall for 11 years, says the Halifax

EPA

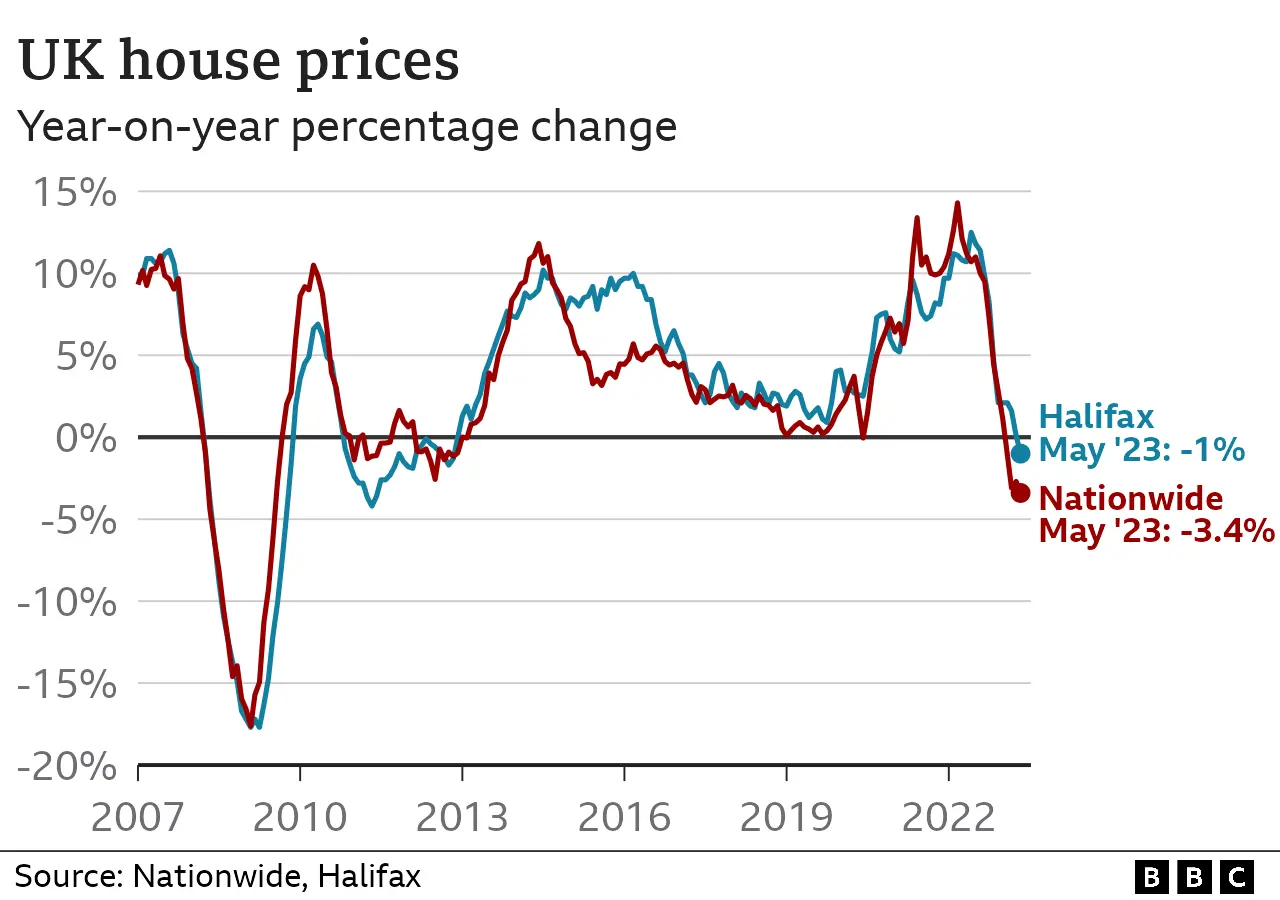

EPAHouse prices have fallen by 1% compared with a year ago - the first such drop since 2012, according to the UK's largest mortgage lender.

The Halifax, part of Lloyds Banking Group, said typical house prices in May were down £3,000 on a year ago, and £7,500 lower than their peak in August.

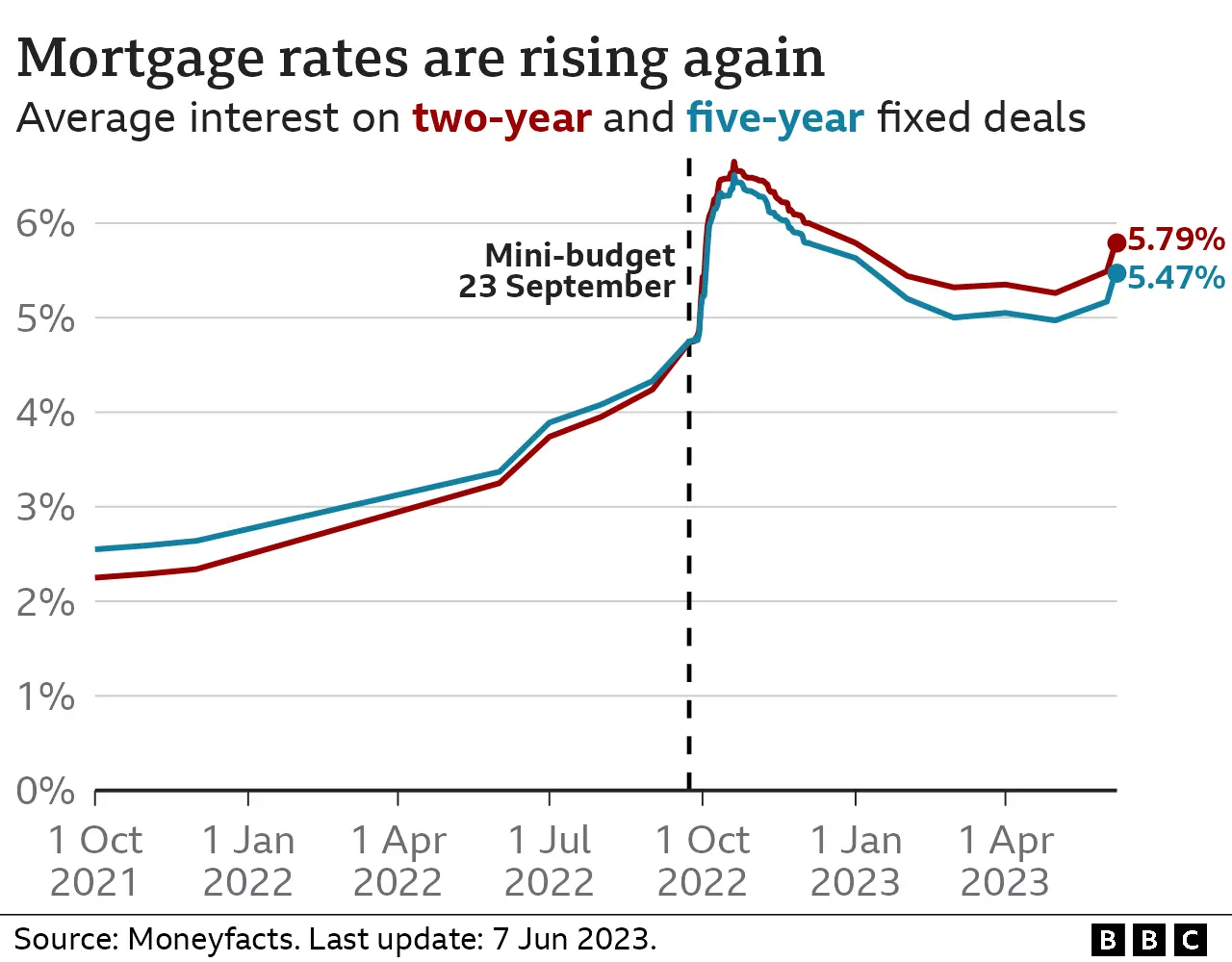

The lender, which itself is raising its mortgage rates, said higher borrowing costs were hitting "confidence".

Some mortgage rates have risen sharply in recent weeks.

It comes as lenders predict further rises in the Bank of England's base rate, owing to general price rises - as measured by inflation - staying higher for longer than previously anticipated.

"This will inevitably impact confidence in the housing market as both buyers and sellers adjust their expectations," said Kim Kinnaird, director of Halifax Mortgages, who added that housing demand was cooling.

"Therefore further downward pressure on house prices is still expected."

The Halifax said that the average UK home now cost £286,532. It said that prices had edged down slightly compared with a month ago. A buoyant market a year ago was a major reason for the year-on-year fall, it said.

Prices had fallen in the south of England, it added, with all other areas - except Wales - recording slowing annual price growth.

Rival lender the Nationwide has recorded a deeper fall in house prices, according to its data. It said a week ago that property values were down in the year to May by 3.4%, the biggest decline for 14 years.

Although that may be welcomed by first-time buyers, higher than expected mortgage rates are squeezing their purchasing power.

Separate figures also show that the rising cost of living is likely to be reducing people's ability to save, such as putting money aside for a deposit. UK Finance, the trade body for banks, said the amount saved in instant access savings accounts fell in the first three months of the year - the first drop for 15 years.

Different lenders base their house price assumptions on their own mortgage data. Although that can vary, both the Halifax and the Nationwide are showing a stagnating market with the expectation of further property price falls.

Have you been impacted by rising mortgage rates? You can share your experiences by emailing [email protected].

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

Analysts at Capital Economics forecast that there will eventually be a 12% drop in house prices, on the Halifax measure, from the peak last August.

However, estate agents point to slower price falls in the last month as evidence that property values may not fall much further.

Tom Bill, head of UK residential research at estate agent Knight Frank, said any decline would be kept in check by rising wages, low unemployment, cash sales, record-high levels of housing equity, longer mortgages and savings amassed during the pandemic.

"The UK housing market is coming back down to earth after a strong three years, not falling off a cliff," he said.

According to data from Moneyfacts, the typical rate for new fixed-rate mortgage deal is 5.79% for a two-year deal and 5.47% for a five-year deal.

That is considerably higher than before interest rates started to rise in December 2021, but lower than after the mini-budget of last autumn.

It comes as new data from UK Finance shows people increasingly taking out mortgages over longer terms, with a record one in five first-time buyers opting for mortgages of more than 35 years.

UK Finance suggested customers might be choosing this option "in order to lower monthly payments and, thereby, improve their affordability calculations".

It comes as the UK economy continues to struggle with the impact of high inflation and rising interest rates.

New analysis from the OECD suggests that Germany will be the only developed economy to perform worse than Britain in 2023. The think tank forecasts UK growth will rise by just 0.3% this year before improving moderately to 1% in 2024.

However, this is a slight improvement on its last forecast in March of a 0.2% decline this year followed by a rise of 0.9% next year.

What happens if I miss a mortgage payment?

- A shortfall equivalent to two or more months' repayments means you are officially in arrears

- Your lender must then treat you fairly by considering any requests about changing how you pay, perhaps with lower repayments for a short period

- Any arrangement you come to will be reflected on your credit file - affecting your ability to borrow money in the future