Wage growth slows despite jobless fall

Getty Images

Getty ImagesUK wages rose more slowly in the three months to May, despite a further fall in unemployment, official figures show.

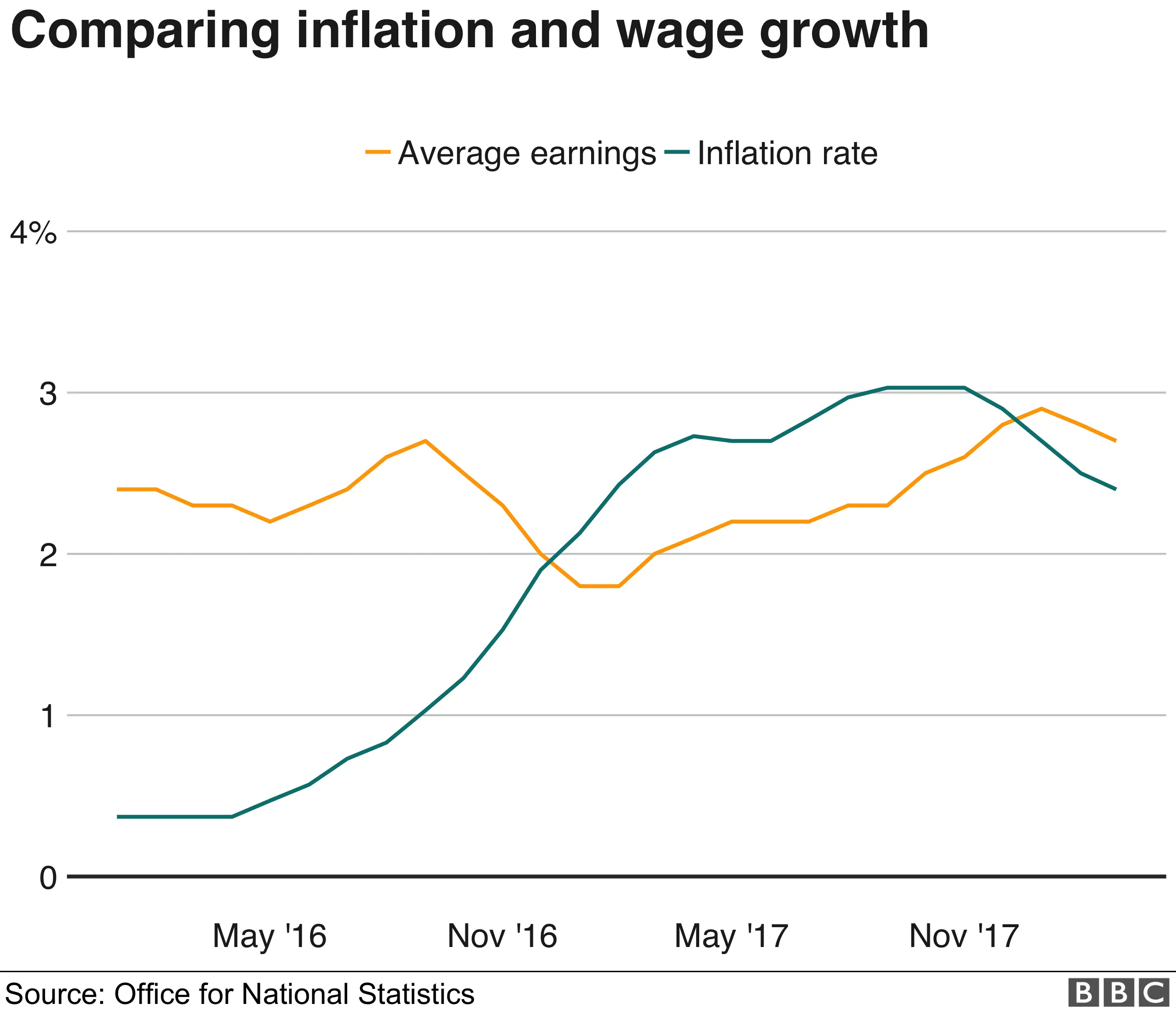

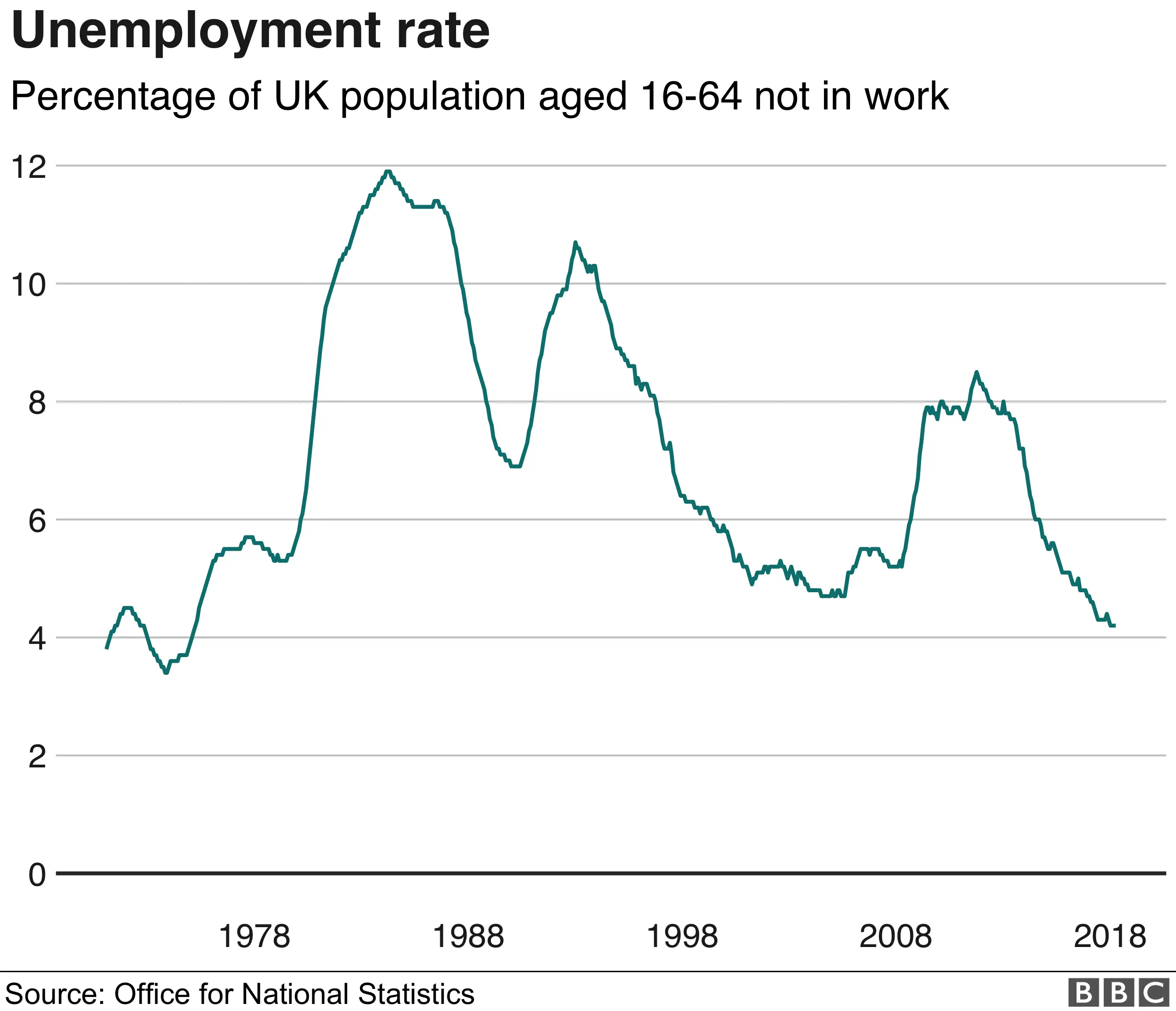

Wage growth slipped to 2.7% from 2.8% in the three months to May, while unemployment fell by 12,000 to 1.41 million, the Office for National Statistics (ONS) said.

The unemployment rate remained at its joint lowest since 1975 at 4.2%.

Some analysts said the slowdown in wage growth could dampen expectations of an interest rate rise next month.

Wage growth is one of the key figures that the Bank of England monitors to assess the health of the UK economy.

Including bonuses, wage growth fell to 2.5% from 2.6% over the same period, the ONS said.

The proportion of people in work rose to a record high of 75.7%.

"We've had yet another record employment rate, while the number of job vacancies is also a new record," said ONS statistician Matt Hughes.

"From this, it's clear that the labour market is still growing strongly."

The Bank of England's Monetary Policy Committee meets on 2 August to decide whether to raise interest rates from their current level of 0.5%.

At their last meeting in June, the nine-member MPC was split 6-3, with dissenters calling for a quarter-point rise to 0.75%.

'Anaemic growth'

Ben Brettell, senior economist at Hargreaves Lansdown, called the latest figures on wages and jobs "mildly disappointing".

"All in all, these numbers don't alter the economic picture of anaemic growth, a relatively tight labour market and under-control inflation," he said.

"Markets are still expecting the Bank of England to raise interest rates in August. But given the increasingly uncertain climate, I think there's a real chance policymakers will sit on their hands and wait for firmer signals the economy is on the right track before risking raising borrowing costs."

However, Andrew Wishart, UK economist at Capital Economics, said he did not think the latest data would deter the Bank from raising rates.

"The recent easing in wage growth looks unlikely to be sustained," he said.

"Leading indicators of pay suggest that it is on track to at least meet the Bank of England's forecast for underlying wage growth of 2.75% y/y in Q4. As such, we continue to expect the MPC to vote to raise interest rates next month."

Suren Thiru, head of economics at the British Chambers of Commerce (BCC), said the latest slowdown in pay growth was "disappointing".

"This means that earnings growth in real terms remains in positive territory by just a small margin and so is unlikely to provide much of a boost to consumer spending power," he said.

"While we expect that interest rates will rise sooner rather than later, with earnings growth underwhelming, there remains sufficient scope for the MPC to keep a rates hike on hold for longer, particularly given the current economic and political uncertainty."

Tej Parikh, senior economist at the Institute of Directors, said: "Clamour for an August interest rate rise has been building, but the sluggish pay growth should give pause for thought.

The Bank should pay heed to the array of obstacles standing in the way of firms, from the burden of business rates to Brexit uncertainty, when it comes to making its decision."