The NHS, taxes and that 'Brexit dividend'

PA

PA"It is our firm intention to reduce taxes on British businesses and working families."

Page 14 of the Conservative Party's 2017 manifesto is clear and could have come straight from the pen of Philip Hammond. The chancellor, those close to him repeat, is something of a tax and spending hawk.

One of the original architects of the economics of "austerity" when he worked in opposition under George Osborne before 2010, Mr Hammond tends to reach first for the vocabulary of reform and efficiency rather than increased spending and taxes when asked about public services.

It is a tendency that became more pronounced after an attempt at a relatively modest increase in taxes on the self-employed announced last spring burned on the altar of a Parliamentary and media backlash.

Within a week, Mr Hammond had to execute a most embarrassing U-turn. For many in the Treasury, that event carries a lesson.

The public are keen to tell pollsters that, yes, they agree with higher taxes - until the government announces higher taxes and the complaints start rolling in from households who haven't seen their incomes increase over the past decade.

That is why the debate on people "contributing a bit more", as Theresa May described it today, is such a difficult one.

And there's more - a second leg to the Conservatives pledge at the last election.

"Sound money and responsible public finances are the essential foundations of national economic success," the manifesto said.

To Mr Hammond, that means bringing down the deficit - the amount of money the government spends above the amount it gains in revenues from taxes and investment - to zero.

Some economists argue that such a focus on "balancing the books" is unnecessary, and that the government could easily borrow more without spooking the international markets which fund Britain's deficit requirements.

But Mr Hammond remains wholly committed to the government's target of a zero deficit by the middle of the next decade.

Borrowing much more - apart from the small amount offered by the slightly better state of the public finances than initially forecast - is off the table as far as the Treasury is concerned.

And with the economy weaker this year, any public revenue boost from the "proceeds of growth" is looking unlikely.

So, what about the "Brexit dividend" which the Prime Minister has said can pay part of the bill for increased government spending?

My sources point out that, yes, in basic public accounting terms, in the financial year 2020-21 the government "gains" £3bn a year from Britain's departure from the European Union. That number rises to £5.8bn by 2022-23.

The figures have been calculated by the independent economic watchdog, the Office for Budget Responsibility (OBR), and are the difference between the government's payments to the EU as part of the "divorce settlement" (£7.5bn in 2023) and what the UK would have been paying if we had remained in the EU (£13.3bn).

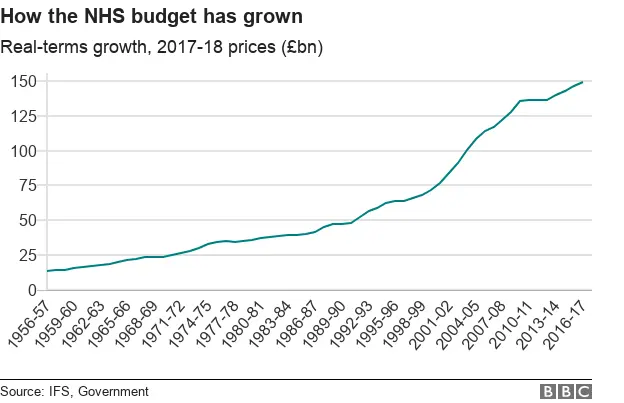

Even if all that money were recycled into the NHS, it would not cover the pledge made by the government of a £20bn a year boost by 2023. But even that "gain" is questioned by economists.

That is for two reasons.

First, the government has already committed some of that money to continuing to support policies and projects presently funded via the EU.

That includes support for farming, support for a "shared prosperity fund" (to replace EU development finance) and support for joint projects with the EU, for example on research into science and education.

There has also been a pledge to continue paying into pan-European regulatory agencies for example on aviation or pharmaceuticals if the right Brexit deal can be struck.

Second, there is the overall economic impact on the public finances from leaving the EU - which most economists say will be significant and negative.

The OBR itself puts the cost to the public finances at £15bn a year by 2023 - money which is going to have to be accounted for.

This is the tough place the government now finds itself, and the Treasury has started the long and difficult process of trying to square a host of conflicting demands.

A manifesto that pledged to reduce taxes and hit the government's deficit target. A pledge to the NHS of £20bn more spending by 2023.

A Brexit "dividend" that is small, has been at least partly committed elsewhere and could easily be washed away by a Brexit effect which many economists say is negative.

Mr Hammond has been tasked with coming up with the answers by the Autumn Budget. But few are convinced he will have all of them by then.