How Trump's tariff chaos could reshape Asia's businesses

Getty Images

Getty ImagesTan Yew Kong, who works at one of the world's largest chipmakers, says his company is like a tailor's shop - it customises chips to meet client's needs.

"We provide the fabric, we provide the cufflinks and everything. You tell us what you like, what design you like and we make it for you," says Mr Tan, who runs GlobalFoundries' operations in Singapore.

Nowadays, the firm is also customising its future to accommodate US President Donald Trump's unpredictable tariff policy.

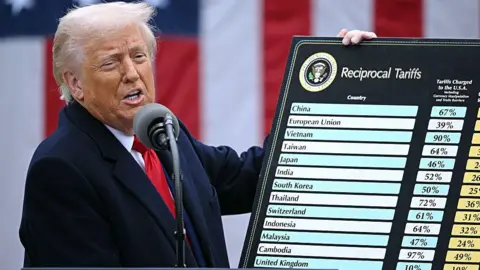

Businesses and countries have been offering to appease Washington ahead of 9 July, when the 90-day pause on Trump's steep "Liberation Day" tariffs ends. And yet again, it's unclear what happens next.

The president said on Friday that the US government is to start sending out letters with details of higher tariff rates that will take effect on 1 August.

He said as many as 12 letters will be sent out over the coming days and the levies will range from "60% or 70% tariffs to 10 to 20% tariffs" but did not name the countries due to receive them.

So far, semiconductors are exempt from tariffs but Trump has threatened levies on them several times, and that uncertainty is making it near impossible for businesses to plan for the future.

Also last week Bloomberg reported the White House is planning to further tighten controls over artificial intelligence (AI) chips by restricting shipments to Malaysia and Thailand to crack down on suspected smuggling of the technology to China.

The US Commerce Department did not immediately respond to a BBC request for comment.

You cannot "flip the switch every other alternate week or day. That makes it very difficult for businesses to plan long term", Mr Tan says.

US-headquartered GlobalFoundries is contracted by some of the world's biggest semiconductor designers and manufacturers - AMD, Broadcom, Qualcomm - to make their chips.

Its factories are spread across the world, with many in Asia, from India to South Korea. It recently announced plans to increase its investments to $16bn (£11.7bn) as demand for artificial intelligence (AI) hardware skyrockets.

To protect that sprawling footprint, the company has also pledged to work with the Trump administration to move parts of its chip manufacturing and supply chain to US soil.

Chip manufacturers, textile producers and car industry suppliers - whose tightly-knit supply chains run through Asia - are rushing to fulfil orders, cut costs and find new customers as they navigate a market in turmoil.

"Businesses need to rethink buffers, increasing their inventory and lead times to account for volatility," said Aparna Bharadwaj of Boston Consulting Group. She adds this could create new opportunities, but also impact their competitiveness and market share in certain countries. In other words, it's hard to say.

"Uncertainty is the new normal."

Winners and losers

When Trump announced levies in April against much of the world, some of the steepest rates were aimed at Asian economies - from long-time allies Japan (24%) and South Korea (25%) to major trading partner Vietnam (46%).

He then hit pause soon after, lowering tariffs on most countries to 10% for the next 90 days. Still the higher rates could return as early as Wednesday.

Getty Images

Getty ImagesMalaysia's prime minister has said tariffs will adversely affect many industries, including textiles, furniture, rubber and plastics. Singapore will be subject to a 10% levy despite having a free trade deal with the US - the prime minister said these are "not actions one does to a friend".

South East Asian countries accounted for 7.2% of global GDP in 2024. So the extra costs that come with tariffs could have severe, long-lasting effects.

In the region only Vietnam has managed to strike a deal so far - US imports from there will now face 20% tariffs, while US exports to Hanoi will face no levies.

Japan and South Korea have been pursuing trade negotiations during the pause, although Trump has threatened Tokyo with an even higher rate - up to 35% - as the deadline looms.

Japanese car makers could be amongst the worst hit. Companies including Mazda have said they are in survival mode because of the time and lengthy processes involved in changing suppliers and adapting their business.

Australia, despite being a key security ally and importing more US goods than it exports, has said it has been telling Washington the rate on it "should be zero".

Indonesia and Thailand have offered to buy more American products and reduce taxes on US imports.

Poorer countries like Cambodia, which have limited bargaining power, face a staggering 49% tariff but cannot afford to buy more US goods.

"Asian economies are reliant on both China and the US... they sort of sit at the heart of the global supply chain," said Pushan Dutt, professor of economics and political science at INSEAD.

"If there are shifts in this global supply chain, if there are shifts in trading patterns, it is going to be much more difficult for them."

He adds that countries with big domestic demand like India may be insulated from trade shocks, but economies that are more reliant on exports - like Singapore, Vietnam and even China - will see a major impact.

A new world order?

In the years after Trump was first elected, Singapore and Malaysia invested in growth industries like chip manufacturing and data centres.

It was partly about so-called friend-shoring – where companies make goods in countries that have good relations with the US. Asian economies also benefited from a "China + 1" supply chain strategy, which involved firms diversifying supply chains beyond China and Taiwan to South East Asian countries.

All of this was to be able to continue reaching the US, which Ms Bharadwaj says is "a critical market for many".

"No matter what happens with tariffs, the US remains an important customer for many Asian businesses," she adds. "It's the largest world economy and has a dynamic consumer base."

Getty Images

Getty ImagesBeyond the South East Asian producers, Trump's tariffs also raise costs for American companies that have been operating in the region for decades.

The clothing and footwear industry stands to suffer - brands like Nike have long outsourced manufacturing to countries like Vietnam and Indonesia.

Some US brands have already said they'll need to pass costs onto customers because tariffs make the price of imported goods significantly higher.

Experts say foreign investments could shift from Vietnam, Laos and Cambodia to countries with lower tariffs, like the Philippines, Singapore, Malaysia and Indonesia.

Businesses may also look for new customers - with the European Union, the Middle East and Latin America emerging as alternative markets.

"We are no longer doing globalisation but more of a regionalisation," said Mr Tan of GlobalFoundries. "Find a place that we feel safe. We feel that the supply will be continued. And people will have to get used to the fact that it is not as cheap as it used to be."

Just as Asia's trade alliances shift, the US has emerged as an increasingly unreliable partner.

"This has actually created a massive opportunity for China to become, sort of, guardian of the world trading order," Prof Dutt says.

The US-Vietnam deal is only the third announced so far, after agreements with the UK and China. Until more happen, businesses and economies in Asia may have to forge a new path.

"As the US and others embrace increased protectionism, Asia is moving in the opposite direction, as pro-business governments are increasing trade openness," Ms Bharadwaj says.

"Tariffs are accelerating two macro trends: slowing of trade between China and the West, and accelerating trade between China... and emerging Asian countries."

Trump's policies have created trade turmoil that could transform the global economic order, and the US may not necessarily come out as the winner.

Prof Dutt sums up what is happening in the words of an old proverb: "Bow to the ruler, and then go your own way."