Shock drop in shop sales adds to worries over UK economy

Getty Images

Getty ImagesShop sales in the UK unexpectedly fell in the run up to Christmas due to a "very poor month" for food being sold in supermarkets, adding to concerns over the health of the UK economy.

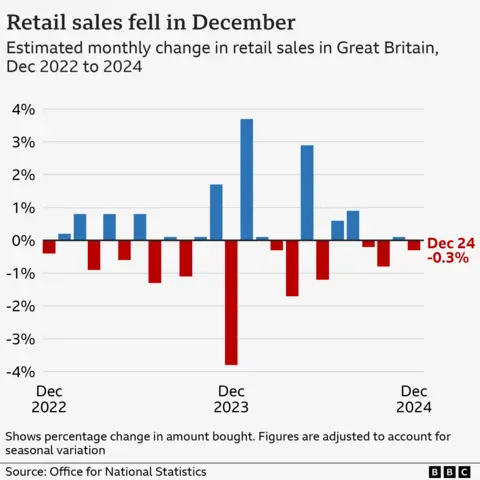

Sales fell by 0.3% in December, according to official figures, well below expectations of a 0.4% rise.

Food sales sank to their lowest level for more than 10 years last month, but clothing shops and department stores saw a boost in trade.

The weak data followed sluggish economic growth figures, although a report from the International Monetary Fund (IMF) later on Friday saw it upgrade its forecast for UK growth this year.

The pound slipped to $1.216 immediately following the release of the retail sales figures, but then recovered to $1.22. Government borrowing costs over a 10-year period also retreated further from recent peaks, as expectations grow that the Bank of England will cut interest rates next month.

The expectation of a rate cut also helped push up share prices, sending the FTSE 100 stock index of the UK's biggest publicly-listed companies to hit a record high on Friday.

The moves come at the end of a week that has seen Chancellor Rachel Reeves face intense scrutiny over her economic plans.

Labour has made growth its key objective, but figures released on Thursday showed the economy flatlining, prompting Reeves to admit the government had to "do more to grow our economy", in order to boost living standards.

In a response to calls to boost growth, regulators suggested strict rules on mortgage lending could be loosened to allow more people to borrow for a home.

The blow to the retail sector last month was driven by a drop in sales volumes in supermarkets, but butchers and bakers, along with alcohol and tobacco/vaping shops also struggled, according to the Office for National Statistics (ONS).

Falling supermarket sales, however, did not appear to have hit the UK's two largest grocers, Tesco and Sainsbury's, which both reported strong trading over the festive period.

Clothing and shoe shops saw sales rise by 4.4%, the ONS said, rebounding from falls in November and October and reflecting the jump in spending pre-Christmas.

Economists said the retail sales figures on Friday capped off a "disappointing" end to 2024 for the sector, in a period businesses typically seek to make the most money to see them through quieter trading months.

"With the chancellor under mounting pressure to deliver growth, the news that retail sales fell in December of all months is at the very least unwelcome," said Danni Hewson, head of financial analysis at AJ Bell.

Alex Kerr, UK economist at Capital Economics, said the worse-than-expected figures were "further evidence that the economy had very little momentum at the end of last year".

But he added it was "not a sign of things to come".

"We doubt the economy's recent malaise will continue," he said, adding that he expected the households' disposable income would grow this year which would boost consumer spending.

In its latest World Economic Outlook, the IMF forecast the UK's economy would grow by 1.6% in 2025, an upgrade from the 1.5% it predicted in October last year.

The global economic body also predicted the UK would see growth outstrip fellow European economies in Germany, France and Italy over the next two years.

Following the forecast, Reeves highlighted that the UK was the only G7 economy, apart from the US, to have its growth forecast upgraded.

However, many businesses have criticised the chancellor's measures announced in the Budget, which will see an increase in the rate of National Insurance paid by employers and a reduction in the threshold they start paying it from April. The minimum wage is also going up.

The boss of Next, Lord Wolfson, told the BBC the changes could make it "harder for people to enter the workforce".

Lisa Hooker, leader of industry for consumer markets at PwC, said 2025 was likely to see the return of "higher price inflation as retailers pass on the increasing cost of doing business".