What tariffs has Trump announced and why?

Reuters

ReutersUS President Donald Trump has doubled US tariffs on steel and aluminium imports to 50% - but the UK will not initially face the higher rate.

Since taking office in January, Trump has announced a series of import taxes on goods from other countries - arguing they will boost American manufacturing and protect jobs.

The move has thrown the world economy into chaos and critics have warned that tariffs are making products more expensive for US consumers.

What are tariffs and how do they work?

Tariffs are taxes charged on goods bought from other countries.

Typically, they are a percentage of a product's value.

A 10% tariff means a $10 product would have a $1 tax on top - taking the total cost to $11 (£8.35).

Companies that bring foreign goods into the US have to pay the tax to the government.

They may pass some or all of the extra cost on to customers. Firms may also decide to import fewer goods.

Why is Trump using tariffs?

Trump says tariffs will encourage US consumers to buy more American-made goods, increase the amount of tax raised and lead to huge levels of investment.

He wants to reduce the gap between the value of goods the US buys from other countries and those it sells to them. He argues that America has been taken advantage of by "cheaters" and "pillaged" by foreigners.

The US president has made other demands alongside tariffs.

When he announced the first tariffs of his current term against China, Mexico and Canada, he said he wanted them to do more to stop migrants and illegal drugs reaching the US.

At the end of May, a US trade court ruled that Trump did not have the authority to impose some of the tariffs he has announced, because he invoked national emergency powers to do so.

But a day later an appeals court allowed those taxes that were enacted under those powere to stay in place while the case continues.

What tariffs has Trump announced?

Steel and aluminium:

A 25% import tax on all steel and aluminium entering the US - including products made from these metals - took effect on 12 March.

On 4 June, the rate was doubled to 50%.

The UK has been temporarily exempted from the higher rate, because of a deal signed with the Trump administration in May, which would see the steel and aluminium levy axed altogether.

However, Trump warned the UK could end up paying the higher rate "on or after July 9" if the agreement is not fully implemented.

The US is the biggest importer of steel in the world after the European Union, getting most of the metal from Canada, Brazil, Mexico and South Korea.

European Union (EU):

Trump initially proposed a 20% tariff on most EU goods, but halved it to 10% until 8 July to allow time for trade talks.

At the end of May he expressed frustration with the lack of progress and threatened to introduce a higher rate of 50% rate on 1 June.

He later said he would extend this deadline to 9 July.

Reuters

ReutersChina:

Trump unveiled a 10% tariff on goods from China on 4 February which doubled to 20% a month later.

On 2 April, Trump imposed a universal 10% baseline tariff on all imports to the US, on what he called "Liberation Day". But some nations, including China, were subjected to higher rates.

China retaliated with its own tariffs, and a war of words between President Xi and Trump led to the US imposing a 145% levy on Chinese imports, on 9 April.

In return, Beijing introduced a 125% duty on some US goods.

After talks in Geneva in May, the US and China agreed to cancel some tariffs altogether and suspend others for 90 days.

The US measures still include 20% aimed at putting pressure on Beijing to do more to curb the illegal trade in fentanyl, a powerful opioid drug.

However both Washington and Beijing have since accused the other of violating the terms agreed.

Canada and Mexico:

Canada and Mexico were also targeted by Trump in February, when he introduced a 25% tax on imports from both countries and a 10% levy on Canadian energy.

There have been a number of delays and exemptions to these tariffs.

In response, Canada introduced a 25% tax on some vehicles imported from the US on 9 April.

Cars:

Since 2 April, foreign-made cars have faced a 25% levy. This was extended to cover imported engines and other car parts on 3 May.

On 29 April, Trump softened the rules to reduce the effect on US car companies.

10% 'baseline' and higher tariffs:

On 2 April, Trump announced most countries - including the UK - would face a 10% "baseline" tariff on all goods sent to the US.

On 9 April, he unveiled a range of much higher tariffs for about 60 countries, described as the "worst offenders" among America's trading partners.

Hours later he announced a 90-day pause, during which the 10% "baseline" rate would be paid by all named countries apart from China.

In response, many countries are working on retaliatory measures.

Smartphones and computers:

An exemption for some electronic devices from China and elsewhere - including smartphones and computers - was announced on 12 April.

Trump later warned the concession could be short lived.

On 23 May, the president threatened to impose a 25% import tax "at least" on Apple iPhones not manufactured in America.

Films:

On 4 May, Trump said he wanted to introduce a 100% tariff on foreign films to boost the US movie industry.

What have the UK and US agreed?

PA Media

PA MediaThe UK and the US reached a narrow agreement over tariffs on some goods traded between the countries in May but this has not yet taken full effect.

The UK exported about £58bn of goods to the US in 2024, mainly cars, machinery and pharmaceuticals.

The blanket 10% tariffs on imports from countries around the world still applies to most UK goods.

However, the deal includes some exemptions to tariffs being applied to other countries.

The agreement cuts the 25% import tax on cars to 10% for up to 100,000 cars - about the number the UK exported to the US in 2024.

The tariff on steel and aluminium is also due to be scrapped completely for imports from the UK.

There will be a quota for how much UK steel can be exported to the US, although it is not yet clear how much this will cover.

In return, the UK is scrapping a 20% tariff on US beef and raising the quota from 1,000 to 13,000 metric tonnes. But minister said there would be no weakening of UK food standards on beef.

The UK's temporary exemption from higher steel and aluminium tariffs was agreed after Business Secretary Jonathan Reynolds met US Trade Representative Jamieson Greer in Paris.

How has the world economy responded to Trump's tariffs?

Trump's various announcements have caused volatility on global stock markets, where firms sell shares in their business.

Many people are affected by stock market price changes, even if they don't invest in shares directly, because of the knock-on effect on pensions, jobs and interest rates.

The value of the US dollar, usually considered a safe asset, has also fallen in recent months.

The International Monetary Fund (IMF) downgraded its prediction for global economic growth in 2025 as a result of the tariffs.

It expects America to be hardest hit, and says a US recession is now more likely in 2025.

At the start of June the influential Organization for Economic Co-operation and Development (OECD) also downgraded its forecast for worldwide growth in 2025, blaming the "significant" rise in trade barriers such as tariffs.

It warned that "weakened economic prospects will be felt around the world, with almost no exception".

As Trump marked 100 days in power in May, the commerce department said the US economy shrank in the first three months of 2025, after strong growth in the last quarter of 2024.

The president insists his trade policy is working, but influential voices within his own Republican Party have joined opposition Democrats and foreign leaders in attacking the measures.

Will prices go up for US consumers?

Price increases are expected across a range of imported goods, as businesses pass on some or all of their higher costs.

Adidas and Barbie maker Mattel are among the global firms which have said they will charge American customers more.

Some companies may also decide to import fewer foreign goods, which could make those that are available more expensive.

The costs of goods manufactured in the US using imported components are also expected to rise.

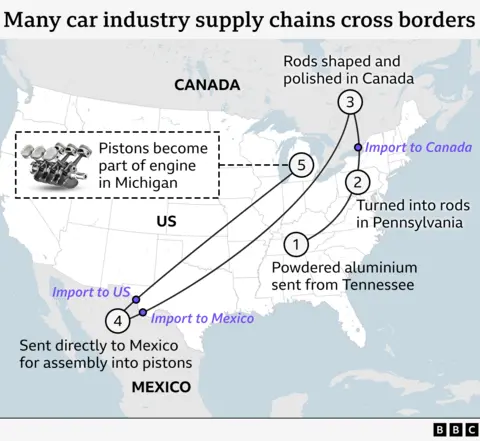

For example, car parts typically cross the US, Mexican and Canadian borders multiple times before a vehicle is completely assembled.

The new tariffs have also resulted in tighter customs checks at the US border, leading to delays.