Why is my council tax rising and how is it spent?

BBC

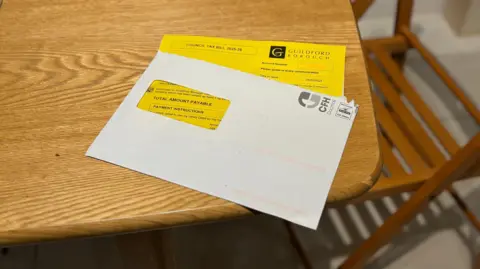

BBCOur council tax bills for the next 12 months are about to arrive and throughout Surrey they are going up by more than £100 compared with last year for a typical Band D home.

Most authorities have gone for the highest rise they are allowed to make without having to ask for special permission from the government and consulting residents.

Some officials have said they need to go for the highest increase to help balance their budgets and maintain services.

The government said it was "fixing the foundations of local government" and had given councils an additional £69bn for the next year.

How much is my bill going up?

Exactly how much you pay in council tax depends on where you live, how large your home is and how many people live there.

Surrey County Council (SCC) has raised bills by 4.99%.

Almost all the borough and district councils have made an increase of 2.99%, although Spelthorne, at 2.90%, just stopped short of the maximum rise.

Cash-strapped Woking Borough Council did not go for another 10% rise, as it did last year.

Some authorities, including Mole Valley and Surrey Heath, have said they are facing difficult financial circumstances.

At a meeting in February, the leader of SCC, Tim Oliver, made the point that the county had one of the highest council tax bills in England.

Where does my money go?

The majority of what we pay in Surrey - around three-quarters - goes to the county council.

The authority spends it on services such as social care and education, transport, public health, libraries, major infrastructure planning and waste management.

Council tax payments make up most of SCC's budget, at 77% .

The remainder is from business rates (12%) and government grants (11%).

Leaders have said there are huge and growing pressures on their budgets, including a demand for services for children with special educational needs and disabilities, as well as home-to-school transport.

If you have a local borough or district council, depending on where you live, between 8-11% of your bill goes to them to help manage services such as housing and planning, collecting and recycling rubbish and managing benefits and business rates.

If you have a parish council, between 1-3% goes towards a smaller authority which represents community views and manages local facilities like allotments and recreation areas.

It can mean your bill is higher than those areas which do not have one.

For example, Outwood Parish Council in east Surrey is asking residents for almost £100 on top of the amount already being paid.

Police, fire and rescue

Wherever you are in Surrey, about 14% of council tax goes on policing.

The precept, or the amount they charge, is set by the Surrey Police and Crime Commissioner, who determines the force's budget need.

This year, an increase of 4.3% has added £14 onto the average annual bill, following a warning about cuts.

Meanwhile, Surrey Fire & Rescue Service is run by SCC.

It is part of a wider department to protect people and prevent emergencies and gets 3.6% of the county council's share of the overall council tax bill.

Paying your bill

Your council tax bill can be paid in one lump sum or in monthly direct debit payments throughout the year.

There are a number of ways to pay which are listed in your bill.

It's a statutory tax which residents are legally obliged to pay under the Local Government Finance Act 1992.

Residents living alone receive a 25% discount on their bill and those on the lowest incomes can get significant discounts of up to 100%.

If we don't pay we can be summoned to court with a maximum penalty of up to three months in prison.

Follow BBC Surrey on Facebook, and on X. Send your story ideas to [email protected] or WhatsApp us on 08081 002250.