What are the Pip and universal credit changes and who is affected?

Getty Images

Getty ImagesThe chancellor, Rachel Reeves, has set out more details about planned benefit cuts as part of her Spring Statement.

The government had already announced that changes to a key disability benefit called personal independence payment (Pip) and universal credit (UC) would save around £5bn a year by the end of 2030 and get more people into work.

Overall, the government estimates that 3.2 million families will be worse off as a result of the reforms by 2030 while 3.8 million families will be better off.

What is Pip and how will it change?

Pip is paid to more than 3.6 million people who have a long-term physical or mental health condition in England, Wales and Northern Ireland.

There are two elements - a daily living component and a mobility component. Claimants may be eligible for one or both.

Under the government's proposals, assessments for the daily living part will be tightened, which the official forecaster - the Office for Budget Responsibility (OBR) - says will affect around 800,000 people.

Pip assessments involve questions about tasks like preparing and eating food, washing and getting dressed. Each is scored on a scale from zero - for no difficulty - to 12 - for the most severe - by a health professional.

From November 2026, the government says people will need to score at least four points for one activity, instead of qualifying for support with a score that could describe less severe difficulties (ones and twos) across a broad range of tasks.

For example, needing help to wash your hair, or your body below the waist, would be awarded two points, but needing help to wash between the shoulders and waist would equate to four points.

The payments for daily living are:

- A standard rate of £72.65 per week

- An enhanced rate of £108.55 per week

Payments for the mobility element - which are not affected - are:

- A standard rate of £28.70 per week

- An enhanced rate of £75.75 per week

Pip is usually paid every four weeks and is tax-free. It does not change depending on your savings or income and does not count as income affecting other benefits, or the benefit cap. You can get Pip if you are working.

At present, the payment is made for a fixed period of time between one and 10 years, after which it is reviewed. You may be reassessed sooner if your circumstances change.

The government plans more frequent reassessments for many people claiming Pip. However, those with the highest levels of a permanent condition or disability will no longer face reassessment.

There is a similar but separate benefit in Scotland called the Adult Disability Payment.

How is universal credit changing?

The government has also announced changes to universal credit, which is paid to 7.5 million people.

At present, more than three million recipients have no requirement to find work due to their health, a number that has risen sharply.

The basic level of universal credit is worth £393.45 a month to a single person who is 25 or over.

But if you have limited capacity to work because of a disability or long term condition, this payment more than doubles, because of an extra top up worth £416.19.

Under the government's proposals, claimants will not be eligible to get this incapacity top-up until they are aged 22 or over.

New claimants will also see this top-up fall from £97 extra per week in 2025-26 to £50 a week by 2026-27, before being frozen until the end of 2029-30.

The higher rate for existing health-related claimants will also be frozen for the same period.

At the same time, the basic payment level for universal credit will rise. When the government first set out its plans, it said it would rise to £107 a week by 2029-30, but the Spring Statement confirmed it would go up to £106.

Who will be affected by the changes?

The Department for Work and Pensions (DWP) says that it expects 3.2 million families – a mixture of current and future recipients - to lose out financially as a result of the total package of measures, with an average loss of £1,720 per year.

This includes:

- 370,000 current Pip recipients who will no longer qualify and 430,000 future Pip recipients who will get less than they would previously have been entitled to, with an average loss of £4,500 per year

- 2.25 million current UC recipients who will be affected by freezing the incapacity top up with an average loss of £500, although this will be partially offset by the increase in the standard allowance of UC

- 730,000 future UC recipients who will lose an average of £3,000 per year.

However, these calculations don't take into account the effects of the extra £1bn the government it says it will spend to help those with disabilities and long-term health conditions find work.

It expects this support will mitigate some of the predicted financial losses.

In addition, the DWP says 3.8 million families will gain an average of £420 a year as a result of the increase in the standard UC allowance and changes to the assessment process.

What is being done to get more people into work?

Getty

GettyThe government says it wants to help those who can work back into employment, while doing more to protect those with severe conditions who are unable to do so.

As part of this it will invest £1bn in what it calls "high-quality, tailored and personalised support" to help people find jobs.

A number of changes have been announced which the government hopes will break the link between trying to get into work and losing benefits.

The work capability assessment, which checks eligibility for the health related top-up to universal credit, will be scrapped by 2028.

Instead, claimants will have to go through the Pip system to claim for a health benefit. The government says they will be assessed on how their disability affects their daily life, rather than on their capacity to work.

While you can receive universal credit or Pip while in employment, universal credit is means-tested and tapers off as earnings increase, while Pip is not affected by how much someone works or their level of savings.

A new "right to try" system will mean people will not be financially penalised if they take a job which doesn't work out.

The government will also consult on merging employment and support allowance and jobseeker's allowance into a single time-limited benefit that is not means-tested. This would be more generous but available for a shorter period.

"If you have paid into the system, you'll get stronger income protection while we help you get back on track," Work and Pensions Secretary Liz Kendall said.

Why does the government want to cut welfare spending?

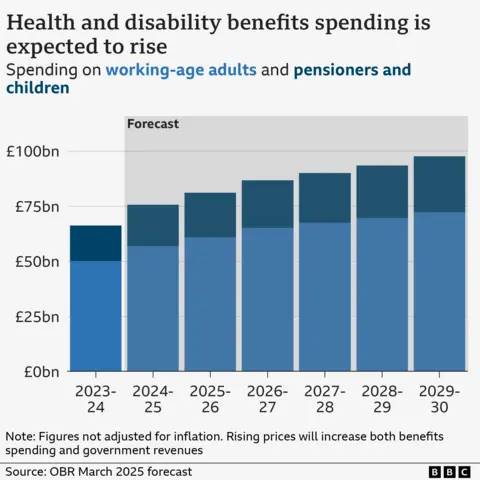

Overall, the government currently spends £65bn a year on health and disability-related benefits. Before the government announced the Pip and UC changes, this was projected to increase to £100bn by 2029.

Pip is the second-largest element of the working-age welfare bill, with spending due to almost double to £34bn by 2029-30.

When Pip was introduced in 2013, the aim was to save £1.4bn a year by reducing the number of people eligible for payments. However, initial savings were modest and the number of claimants has risen.

About 1.3m people now claim disability benefits primarily for mental health or behavioural conditions.

That is 44% of all working age claimants, according to the independent economic think-tank, the Institute for Fiscal Studies (IFS).

The OBR now predicts welfare spending on working-age adults will be £72.3bn by 2029-2030. Spending on pensioners and children is expected to be £25.4bn.