Decline in banking services 'infuriating' small businesses

BBC

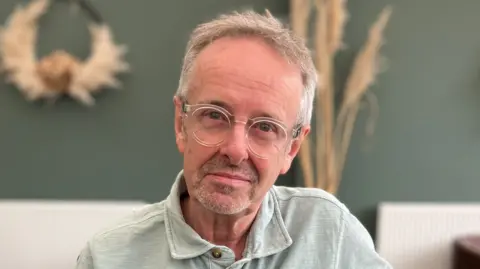

BBCA small business owner has said the decline in banking services is "utterly infuriating".

Peter Burrows from the Conservatory Cafe in Killinchy, County Down, had his bank account suspended twice in the last six years.

Small business owners like him said branch closures in Northern Ireland have led to a reduction in the number of services that are offered.

The Federation of Small Businesses in Northern Ireland (FSB NI) commissioned a report of over 300 members about their banking experiences.

It found newer businesses were more likely to be turned down by a bank, which the report suggests is stunting growth.

Interacting with banks is an important part of running a small business, but some said their processes add a cost burden, and can be time-consuming and frustrating.

'What is this all about?'

The first time Mr Burrows' bank account was suspended, it happened after he was asked for an annual statement but had only been trading for 10 months.

"I was shut off from my banking for three weeks," he told BBC News NI.

"They were happy to take credit card payments, but they weren't happy to let me pay my bills or direct debits going out.

"The food business works pretty much with direct debits and regular payments; you are getting deliveries maybe twice a week.

"So if you can't pay your supplier on a weekly cycle, they are starting to say why can't you pay us?"

The same thing happened last year because of an issue with his state pension.

"We are very definitely a small business; we keep it low.

"I have got to the stage in life where I don't want to be a big businessman and you just think, what is this all about?

"I think the banks have to be compliant with the Financial Conduct Authority, but it is a box-ticking exercise for them," Mr Burrows said.

"They don't care whether it's little old me and they use this hammer to get it done," he added.

Banking experiences 'worrying'

FSB NI Chair Alan Lowry said the report's findings are "worrying".

"People know banking from their own personal point of view, but for a business that really is the lifeblood; cash flow for any small business is so important.

"Money in, money out, and being able to manage that in a really good way and the services you need."

He suggested these challenges are holding back economic growth in Northern Ireland.

"We want to see our small businesses thriving, and at the minute most of them are just surviving," he said.

"If a business needs to get a loan, it needs to get it for a reason and it needs it quickly.

"The problem is, when faced with that disconnect, businesses are then turning to other people for advice, not necessarily the best people, and we've seen that in the past where people are ending up with very high interest rates, tied into onerous payments - it's going to kill businesses," he added.

Mr Lowry said banks need to be seen as a "trusted partner".

"That's the problem - at the minute, they aren't being seen as that trusted partner."

'Banking landscape has changed'

It's estimated there are about 115 branches in Northern Ireland, about 480 Post Offices with banking services and six banking hubs.

Managing director of Commercial Finance at UK Finance, David Raw, said the banking industry is fully committed to supporting businesses in Northern Ireland.

He said: "There is a competitive market and a wide choice of banks that provide business services.

"The banking landscape has changed, with many businesses preferring the convenience and speed of digital channels to interact with their bank, although there are still a large number of branches as well as Post Offices and new banking hubs.

"We will continue to work the FSB to ensure businesses in Northern Ireland get the support they need," he added.